In real estate, both private insurance and government-backed coverage play crucial roles in risk management. Private insurers provide flexible policies with faster claims processing and broader coverage options for unique properties, while government-backed programs like GSEs offer stability, guaranteed protection during economic downturns and natural disasters, along with accessibility and lower premiums, especially for first-time buyers. Choosing between them depends on individual needs; evaluating budget, property value, and specific requirements is essential to make an informed decision that protects investments in the dynamic real estate market.

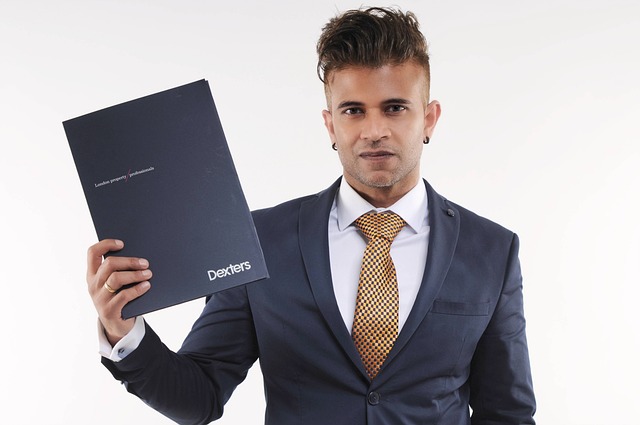

In the dynamic landscape of real estate, ensuring comprehensive protection is paramount. This article delves into the dual aspects of property coverage: private and government-backed options. We explore the nuances of each, their distinct advantages and drawbacks, and provide insights to help you make an informed decision tailored to your unique property needs. Maximize your investment’s security – understand the real estate coverage that best suits your situation.

Understanding Private and Government-Backed Real Estate Coverage

In the realm of real estate, understanding coverage options is paramount for investors and homeowners alike. Private and government-backed coverage play pivotal roles in protecting properties against unforeseen risks and financial losses. Private insurance, often offered by private insurers, caters to individual needs with flexible policies. These policies can be tailored to specific property types, offering comprehensive protection against perils like fire, theft, natural disasters, and liability claims.

On the other hand, government-backed coverage, such as those provided through national programs, offers a different approach. Designed to safeguard the broader community, these programs ensure accessibility to affordable insurance for all. Examples include government-sponsored enterprises (GSEs) that pool risks and resources to back mortgages, thereby influencing real estate markets. Such coverage mechanisms foster stability, enable homeownership, and ensure that buyers and sellers navigate transactions with peace of mind.

Advantages and Disadvantages of Each Coverage Type

Advantages and Disadvantages of Private vs Government-Backed Coverage in Real Estate

Private coverage in real estate offers several advantages, such as tailored policies that cater to specific property needs, competitive rates, and faster claim processing due to direct interaction with insurance companies. Additionally, private insurers often provide broader coverage options, including specialty policies for unique properties or high-value assets. However, a potential disadvantage is that these policies may lack the built-in protections against market fluctuations found in government-backed programs.

On the other hand, government-backed coverage, like those offered through national insurance schemes, provides stability and guaranteed protection. These programs often include provisions for natural disasters and economic downturns, ensuring homeowners are not left vulnerable during uncertain times. However, government coverage might offer less flexibility in terms of policy customization and could result in higher administrative fees. Additionally, waiting periods or eligibility criteria may apply, which could be a drawback for those seeking immediate protection.

Making an Informed Decision: Choosing the Right Coverage for Your Property

When it comes to insuring your property, whether it’s a home or a commercial space in the real estate sector, making an informed decision is paramount. The choice between private and government-backed coverage depends on various factors unique to your situation. Private insurers offer tailored policies that cater to specific needs, providing flexibility and often more personalized service. On the other hand, government-backed programs like FHA or VA loans for real estate investors can be advantageous due to their accessibility and potentially lower premiums, especially for first-time buyers or those with limited credit history.

Understanding your budget, the value of your property, and your specific requirements will guide you in selecting the right coverage. Private insurance allows customization, including options for comprehensive or specific perils coverage. In contrast, government-backed programs usually come with standard policies that align with broader regulations, ensuring a level of protection but potentially leaving out unique risks. Weighing these options carefully will ensure you make a decision that protects your investment in the dynamic real estate market.